China’s EV Market: A Rollercoaster Week of Insurance Registrations for Major Brands

2024-12-10

Author: Nur

China’s EV Market: A Rollercoaster Week of Insurance Registrations for Major Brands

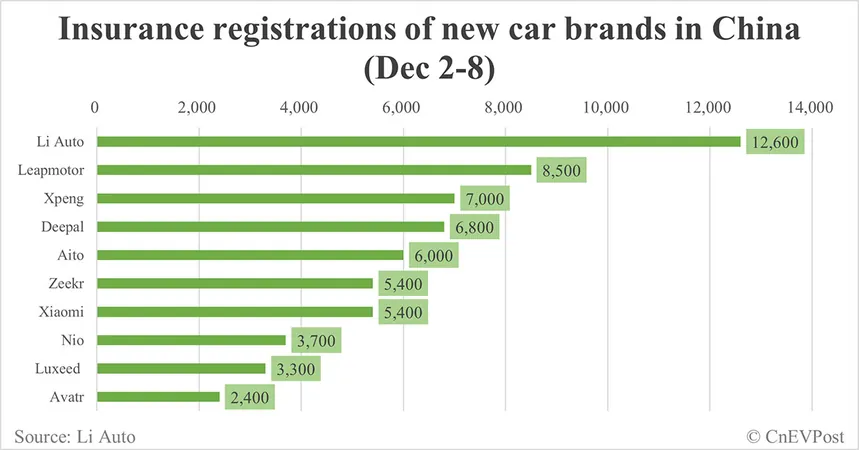

In a surprising turn of events in the Chinese electric vehicle (EV) market, major brands experienced fluctuating insurance registrations for the week ending December 8. As the industry braces for year-end sales, the latest figures reveal how leading companies are faring amidst a generally slower delivery period.

Nio, Tesla, Xiaomi, and BYD Lead the Charge—But Not Without Struggles

In the latest update, Nio reported 3,700 insurance registrations, which marks a 9.76% decrease from the previous week's 4,100 registrations. This downward trend follows a strong November during which the brand delivered 20,575 vehicles—a 28.92% increase year-on-year, although a slight decline from October’s numbers.

Tesla, however, enjoyed a robust week with 21,900 new insurance registrations—an impressive 17.11% rise compared to the prior week. This places Tesla’s weekly registration at the second-highest level recorded. November was a stellar month for Tesla in China as well, with total sales reaching 78,856 vehicles, including exports, a notable 81.52% boost from October sales.

Meanwhile, BYD led the pack with a whopping 85,000 insurance registrations, despite a 13.09% drop from the last week's 97,800 registrations. BYD continues to dominate the new energy vehicle market, selling over half a million units in November alone—solidifying its status as a key player in the fast-evolving EV landscape.

Emerging Competitors: Li Auto, Xpeng, Zeekr

Li Auto saw its insurance registrations rise to 12,600 as it recorded a 5.88% increase compared to 11,900 the previous week. In November, the company delivered 48,740 vehicles, demonstrating its growth potential despite a decrease from October figures. The brand has also introduced an enticing limited-time 0% interest financing offer, an attempt to keep the momentum going.

Xpeng faced challenges too, with its registrations falling by 25.53% to 7,000 for the week. November was still a bright spot for the company as it surpassed 30,000 vehicle deliveries for the first time, a record achievement indicating strong demand and growth potential looking ahead.

Meanwhile, Zeekr managed to maintain relatively stable performance with 5,400 registrations, reporting a staggering 106.13% increase in vehicle deliveries compared to the same month last year. The brand is aggressively targeting an ambitious 230,000 total deliveries for 2024.

Growing Brands: Leapmotor, Onvo, Aito

Leapmotor reported 8,500 registrations, representing a 7.61% decrease from the previous week but still marking a historic milestone as the first month where monthly deliveries topped 40,000 units. The rapid growth positions Leapmotor as a serious contender as they aim for aggressive sales targets in the coming years.

Nio's sub-brand, Onvo, saw its insurance registrations fall to 1,430, down 18.75% from the prior week. Despite the decline, Onvo's deliveries have steadily increased since its September launch, underscoring the potential of new entrants in the EV market.

Lastly, Aito recorded 6,000 insurance registrations, experiencing a 22.08% drop from 7,700 the previous week. The joint venture between Huawei and Seres Group illustrates the expanding avenues in the EV market fueled by partnerships and innovation.

Conclusion: A Mixed Bag for China’s EV Giants

As 2023 draws to a close, the electric vehicle market in China appears vibrant yet volatile. While some major players have experienced a decline in insurance registrations recently, their overall performance remains strong, driven by innovative offerings and strategic promotions. With aggressive sales targets set for December, it will be intriguing to see how these brands maneuver in the coming weeks to capture a larger share of the fast-growing EV market. Don’t miss out on how these dynamics could reshape the EV landscape in 2024!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)