Crypto Market Update: Optimism Amidst Record Short Bitcoin ETF Volume

2024-12-06

Author: Daniel

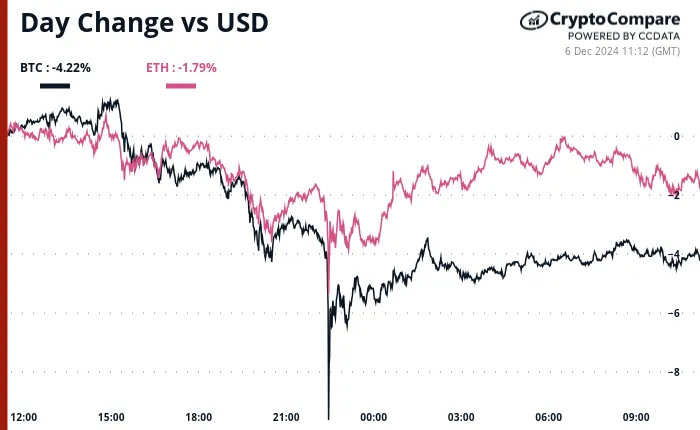

As the crypto landscape evolves, today marks an intriguing moment for investors and traders alike. The ongoing fluctuations in Bitcoin prices signal a tug-of-war between bullish and bearish sentiments within the market. Early Thursday witnessed an impressive surge, with Bitcoin climbing above $103,000, only to see a dramatic reversal that crashed prices down to approximately $91,000. Presently, Bitcoin is trading around $98,000, highlighting the indecisiveness of the current market.

The rapid swing in prices resulted in the liquidation of roughly $1 billion in leveraged crypto futures, a much-needed reset for an overly heated market. While some may view this volatility as detrimental, it can also be seen as an opportunity to stabilize and restore investor confidence before the market rallies again.

Adding a silver lining to this scenario, Bitcoin spot ETFs have attracted a substantial net inflow of $766 million, reinforcing the belief that institutional interest in Bitcoin remains strong despite the chaos. However, the surge in short positions cannot be ignored. The ProShares Ultra Short Bitcoin ETF experienced a record trading volume, indicating that bearish sentiments are proving resilient.

Looking ahead, market dynamics could shift dramatically depending on upcoming U.S. nonfarm payroll data, which is set to be released shortly. A robust labor market with persistent wage pressures could provoke renewed scrutiny of the Federal Reserve's rate-cutting timeline, potentially impacting crypto prices negatively. Conversely, disappointing economic indicators could lead to a price bounce, although navigating these volatile waters will prove challenging.

In political updates, President-elect Donald Trump's recent appointment of David Sacks as the 'Crypto and AI Czar' brings a wave of speculation about what this could mean for the crypto sector, particularly for Solana and its ETF prospects. Sacks has connections to the crypto space through his previous work with Multicoin Capital, which cultivated early investments in Solana.

Meanwhile, the broader DeFi landscape is also experiencing significant movements. The HYPE token from Hyperliquid is closing in on the market capitalization of Arbitrum’s ARB token. As Gautham Santosh of Polynomial Protocol noted, this trend signifies the growing significance of application-specific layer two solutions in capturing value in the DeFi domain.

Additionally, as 'meme coins' make headlines, the latest surge in the popularity of Ethereum and Base's memecoin MOG following a Coinbase listing demonstrates the influence of community-driven narratives. Highlights of today's market movements include Bitcoin's current stability despite recent market volatility, suggesting a keen observation will be required for what comes next.

Crypto Events to Watch:

- **Dec. 18:** CleanSpark (CLSK) Q4 FY 2024 earnings report. - **Dec. 6:** Release of the U.S. Employment Situation Report, critical for assessing economic health.

As traders navigate these tumultuous times, they are reminded to focus on long-term portfolio construction rather than short-term fluctuations. Stay vigilant and ready for further developments in this ever-changing crypto arena.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)