Crypto Markets Show Little Reaction After HBO’s Disappointing Satoshi Nakamoto Reveal

2024-10-09

Author: Yu

Crypto Markets Show Little Reaction After HBO’s Disappointing Satoshi Nakamoto Reveal

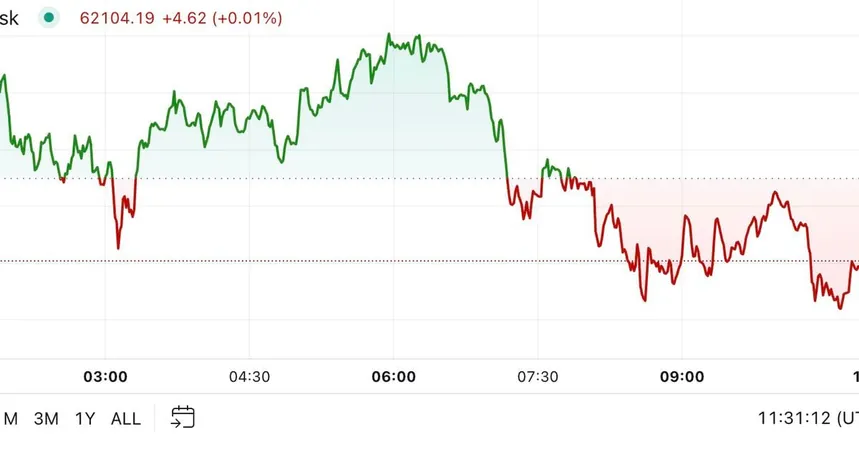

The cryptocurrency market remains largely unchanged following the premiere of HBO’s documentary "Money Electric: The Bitcoin Mystery," which many anticipated would reveal the elusive identity of Bitcoin’s creator, Satoshi Nakamoto. Instead, the film pointed to Bitcoin developer Peter Todd as the potential pseudonymous figure behind the currency, a claim that Todd himself denied prior to the airing.

Historically, new claims or potential identifications of Satoshi have led to increased volatility in crypto markets. However, HBO’s attempt, much like numerous previous ventures, failed to stir significant movement. Currently, Bitcoin's price hovers around $62,150, reflecting a slight decline of approximately 0.45% over the last 24 hours. Meanwhile, the broader digital asset landscape, as indicated by the CoinDesk 20 Index, also exhibited minimal changes.

In a separate development, U.S. spot bitcoin ETFs experienced a significant outflow, with investors withdrawing over $18 million on Monday, while Ether ETFs saw withdrawals surpassing $8 million. This low volatility can be attributed to a lack of new stimulus announcements following a recent Chinese government briefing, which raised concerns and diminished hopes for a substantial economic stimulus package. In turn, China's stock markets experienced heavy losses, with the Shanghai Composite Index plummeting 3.9% and the Shenzhen Component Index dropping by 4%.

Investors are now looking ahead to insights from the Federal Reserve's September meeting, which may shine light on Bitcoin's future movements. A notable bitcoin options trade suggests that market participants are anticipating a transition from the current low-volatility environment to a phase of greater price fluctuations. This particular trade involved a substantial net premium of over $1 million for purchasing 100 contracts of $66,000 strike call and put options, set to expire on November 29.

Lin Chen, head of business development for Asia at Deribit, explained that a long straddle strategy is employed when significant price movement in either direction is anticipated, enough to outpace the cumulative premium paid. For this strategy to yield a profit, Bitcoin would need to either rise above $87,000 or fall below $53,000 by the end of November.

As the crypto landscape continues to navigate through these speculative waters, all eyes are on upcoming regulatory announcements and economic signals that could sway market momentum. Will the true identity of Satoshi ever be unveiled? Only time will tell, but for now, the crypto market remains in a cautious watch-and-wait phase. Stay tuned for more updates!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)