Family Feud Over $700K HDB Flat Uncovers Alarming Retirement Woes for Singapore's Seniors

2024-11-20

Author: Yu

An Unexpected Family Divide

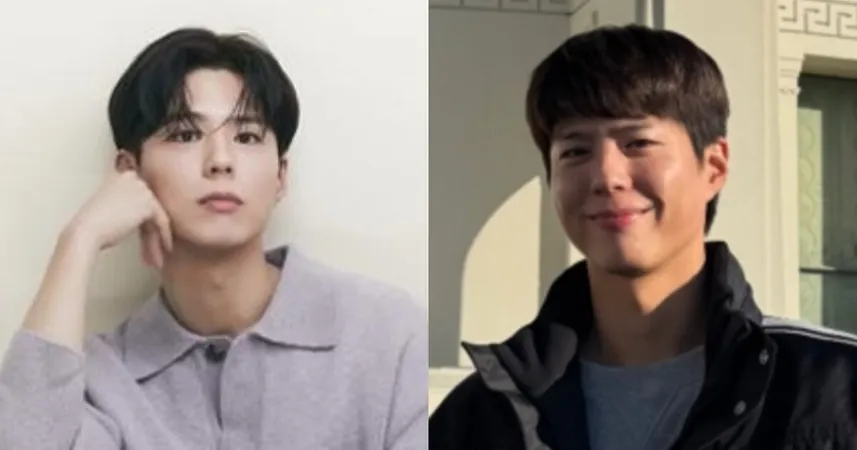

At the center of this dispute are 90-year-old Mrs. Tan and her 69-year-old son, a retired artist, who co-own a flat valued at approximately $700,000. While the son resided in the flat for years, renting out two rooms for a monthly income of $1,500, Mrs. Tan had been living with her eldest daughter due to her deteriorating health, primarily caused by advancing dementia.

In 2023, the daughter filed a petition with the High Court to compel the sale of the flat, asserting that the proceeds were necessary to cover their mother's escalating medical and nursing expenses. However, her brother strongly opposed the sale, fearing it would render him homeless and financially vulnerable, especially after suffering a stroke that prevented him from working.

The Court's Compromise

The legal ruling struck a balance between the conflicting needs of both parties. High Court Judge Choo Han Teck emphasized the paramount importance of Mrs. Tan's healthcare needs, stating that it was inequitable for the son to continue profiting from the home while their mother faced mounting financial pressures due to her health condition.

The court granted the daughter permission to sell the flat, mandating an equal split of the proceeds between Mrs. Tan and her son. Each party would receive a minimum of $350,000—an amount that would help the son secure a new living arrangement.

A Cautionary Tale of "Asset Rich, Cash Poor"

This case serves as a stark reminder of the vulnerabilities associated with being "asset rich, cash poor." Although their flat held substantial value, the family's financial situation underscores a crucial point: cash flow may be even more vital than asset ownership in retirement.

Many older homeowners face grim decisions when they can no longer rely on real estate for a steady income. For instance, a local man living in a $10 million bungalow opted to deal with financial hardship rather than downgrade to a smaller, more manageable residence that would still afford him considerable savings. Similarly, a 74-year-old condo owner stuck in a rundown unit has accrued over $250,000 of debt while struggling to maintain his current lifestyle.

Expert Financial Planning Strategies

In light of such precarious situations, financial experts advocate for a proactive and diversified retirement strategy that includes more than just property ownership:

1. **Explore the Lease Buyback Scheme:** For seniors above 65, this program allows homeowners to sell part of their flat’s lease to the HDB, generating income while remaining in their homes. This could serve as a vital supplementary income source alongside their Central Provident Fund (CPF) Retirement Accounts.

2. **Amass Sufficient Savings:** Regular contributions to CPF Retirement Accounts can yield substantial payouts. Those who reach the full retirement sum of $213,000 can expect around $1,730 monthly starting at 65. Couples with an enhanced retirement sum of $426,000 could secure over $6,000 monthly—providing a significant safety net for living and healthcare costs.

3. **Create Ongoing Income Streams:** Developing a comprehensive financial plan that includes annuities and diverse investments enhances the likelihood of receiving consistent income throughout retirement. For instance, the CPF Life national annuity scheme provides monthly payouts that can ease concerns about outliving savings.

Conclusion: Balancing Assets and Income

The family's struggles portray a poignant lesson on financial planning. While homeownership is often regarded as a significant asset, it’s vital to ensure that seniors have sufficient liquid assets and savings to navigate the complexities of aging, healthcare, and unexpected costs.

A balanced financial strategy that integrates both property and cash resources is essential to prevent the pitfalls of being "asset rich, cash poor." In an era where health and longevity are increasingly intertwined with finances, preparing a robust retirement plan has never been more crucial.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)