Gold Soars to All-Time High Amid Stock Market Turmoil as Trump Targets Fed

2025-04-22

Author: Wei

Gold Hits Unprecedented Levels

In a dramatic turn of events, gold prices skyrocketed to an astonishing US$3,500 an ounce on April 22, marking the first time this precious metal has reached such a peak. This surge comes in the wake of U.S. President Donald Trump's aggressive tariffs and scathing remarks aimed at the Federal Reserve, prompting investors to flock to this safe-haven asset.

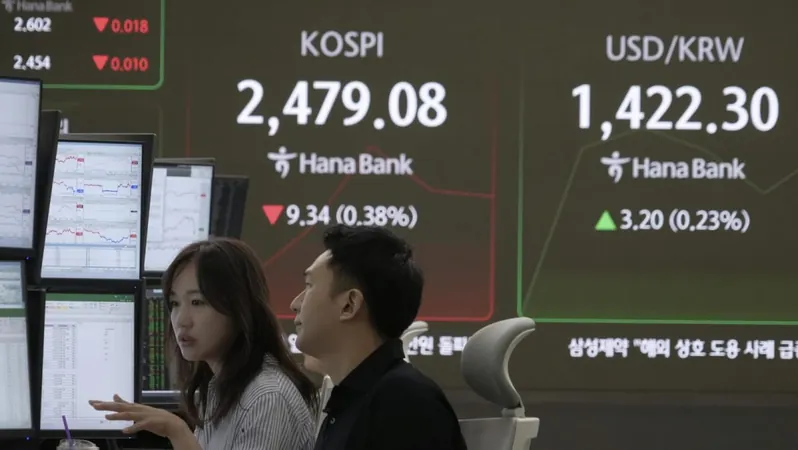

Stock Markets Experience Uneven Reactions

As trading resumed in Europe following the Easter break, major stock markets displayed mixed results. Asian indices mirrored this varied response, while the dollar fluctuated against its major rivals. At the same time, oil prices showed signs of recovery.

Analysts Brace for Economic Insights

All eyes are fixed on the International Monetary Fund’s (IMF) impending forecasts for global economic growth, especially concerning the ramifications of the ongoing trade war on worldwide output and inflation. Matt Britzman, a senior equity analyst at Hargreaves Lansdown, commented, "The uncertainty is driving investors straight into the arms of traditional safe havens like gold and the Japanese yen, both of which are benefitting from the current market drama."

Trump's Worrying Remarks on the Federal Reserve

The turbulence in the markets has been exacerbated by President Trump’s recent tirades regarding Federal Reserve Chairman Jerome Powell. Trump expressed dissatisfaction with Powell, even suggesting his dismissal could be imminent. This uncertainty was fueled by Trump's comments that the Fed should implement pre-emptive interest rate cuts, referring to Powell as a "major loser" and "Mr. Too Late." He dismissed inflation concerns, asserting that costs for energy and food have significantly declined.

Investor Panic and Market Volatility

Wall Street reacted strongly to Trump's proclamations, resulting in a nearly 2.5% drop across major U.S. indexes. Analysts warn that if Trump indeed attempts to oust Powell, it could trigger a crisis of confidence in the U.S. economy. Michael Brown, a strategist from Pepperstone, stated, "If Powell were to be fired, we would immediately see massive volatility in financial markets and a frantic sell-off of U.S. assets. Expect plummeting equities, widespread Treasury sales, and a potentially catastrophic fall of the dollar."

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)