Malaysian Tycoon Expands Horizons: Why Acquiring Cold Storage and Giant Stores is a Game-Changer for the Retail Landscape

2025-03-27

Author: Mei

KUALA LUMPUR: Malaysian retail giant Macrovalue has made headlines this week with its strategic acquisition of Singapore's renowned Cold Storage and Giant supermarket chains, a bold move valued at S$125 million (approximately US$93 million). This significant transaction positions Macrovalue as Malaysia's third-largest supermarket operator, following industry leaders AEON and Lotus (formerly Tesco).

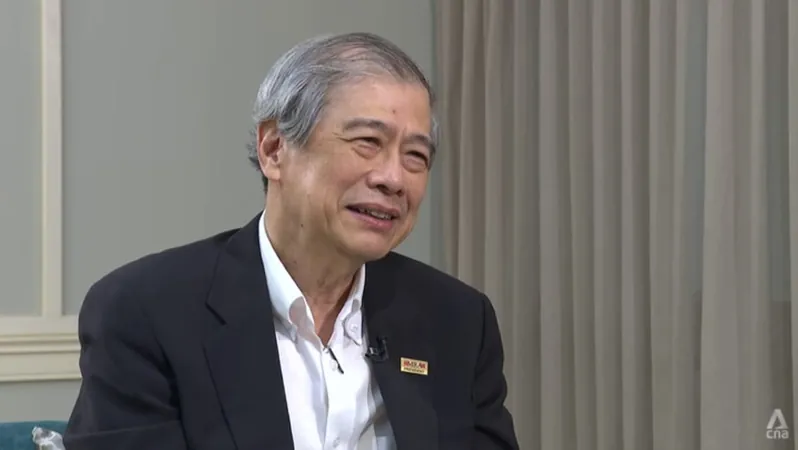

Andrew Lim Tatt Keong, co-owner of Macrovalue, emphasized that the acquisition aligns with the company's broader strategy to achieve economies of scale amid intense market competition. Lim pointed out that successful food and grocery businesses must grow to a size that allows them to negotiate better prices with suppliers. He cites the market dominance of NTUC FairPrice and Central Group in Thailand, which command around 50% market share in their respective regions, and expressed his aspiration for Macrovalue to reach a similar level of influence in Malaysia.

Despite the new ownership, Lim reassured customers and employees that there will be no drastic changes to daily operations: “It will be business as usual. No layoffs. We aim to maintain stability and continuity under the leadership of Lim Boon Cheong, who will guide the transformation of the acquired brands.”

Moreover, Lim indicated that customer loyalty programs, such as Yuu, will be preserved, alongside the existing in-house products under the Meadows brand.

As the Midwest struggles with disruptions caused by e-commerce, particularly in regions with harsh winter climates, Lim sees an opportunity in "summer band countries" like Malaysia and Singapore. Research from Oxford University supports his belief that warm-weather cultures prioritize shopping experiences in physical locations, indicating that lifestyle centers and traditional supermarkets remain in demand.

Recognizing the competitive landscape in Singapore, where rivals like NTUC FairPrice and Sheng Siong have substantial market shares, Macrovalue plans to focus on top-notch customer service and brand building.

Lim’s retail journey traces back to the 1980s. His involvement with GAMA Group, which opened Malaysia's first modern retail complex, equipped him with an extensive understanding of retail operations. Having orchestrated a management buyout of Sogo, Lim has long been passionate about adapting to consumer needs in an ever-evolving market.

The acquisition allows Macrovalue to take control of 48 Cold Storage stores—including those under CS Fresh, CS Gold, and Jason Deli—and 41 Giant stores, in addition to two distribution centers in Singapore. However, the Giant chain has been in decline, with eleven of its locations closing in 2024, signifying a shift at DFI Retail Group towards its health and convenience operations like 7-Eleven and Guardian.

While this acquisition primarily serves business ambitions, Lim has a personal connection to Singapore as he revealed that his mother hails from the city-state. Despite this family link, he insists on employing experienced professionals rather than involving relatives in the business operations: "It's crucial to hire the best people to lead and succeed."

In summary, Macrovalue’s entry into Singapore isn't just about expanding its retail footprint; it's a calculated move aimed at redefining success in a rapidly changing retail environment. As Lim continues to innovate and adapt, consumers are left wondering how these dynamics will reshape their shopping experiences in the years to come. Keep an eye on Macrovalue—this mogul's rise may just redefine grocery shopping across Southeast Asia!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)