Market Meltdown: Japan, Taiwan, and Hong Kong Stocks Plunge 9% Amid Intensified U.S. Trade War!

2025-04-07

Author: Wei

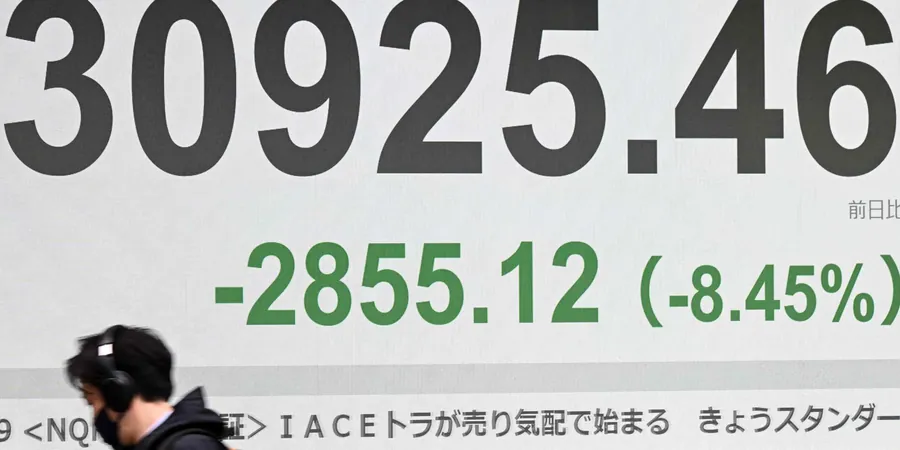

TOKYO — In a shocking turn of events, Japanese stocks experienced a dramatic decline on Monday morning, with the Nikkei Stock Average plummeting an astonishing 8.8% to 30,792.74. This alarming drop was triggered by the escalating tensions from the ongoing U.S.-China trade war, reminiscent of the financial chaos seen during the COVID-19 pandemic.

As global investors reacted to the potential fallout from tariffs imposed by the U.S., the broader Tokyo Stock Price Index (Topix) also took a significant hit, falling by 9.6% and reaching a low of 2,243.21. This marks a staggering decline of approximately 23% from its peak earlier in January, raising concerns about long-term economic stability in the region.

Meanwhile, stocks in Taiwan and Hong Kong mirrored this downward trend, with losses escalating to 9% as uncertainties loom over trade relations. Analysts warn that the impact of these tariffs could lead to a domino effect across Asian markets, igniting fears of a recession. Investors are on high alert, as the ramifications of the tariff war show no signs of abating.

The crisis has reignited fears surrounding supply chains and international trade, pushing many to question the long-term viability of investments in Asian markets. As the situation develops, experts urge stakeholders to stay informed and consider diversifying their portfolios to mitigate risk.

The world watches closely as the U.S. administration continues to wield tariffs as a weapon in trade negotiations. Will this be the tipping point that changes the landscape of international commerce forever? Stay tuned for updates as this unfolding drama attempts to reshape the global economy.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)