Nio Reports Disappointing Q3 Revenue But Sees Margin Improvements – What's Next for the EV Giant?

2024-11-20

Author: Sarah

Nio Reports Disappointing Q3 Revenue But Sees Margin Improvements – What's Next for the EV Giant?

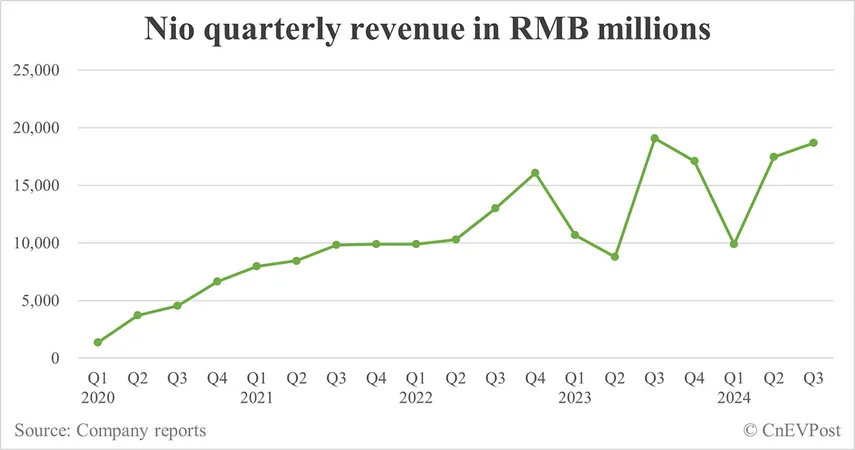

In an anticipated financial release, Chinese electric vehicle manufacturer Nio has unveiled its third-quarter results, revealing lower-than-expected revenue figures despite a noteworthy improvement in gross margins. For the quarter, Nio registered a revenue of RMB 18.67 billion (approximately $2.66 billion), marking a modest decline of 2.1% year-on-year but a more encouraging increase of 7.0% from the previous quarter.

However, the revenue fell short of analyst predictions that forecasted RMB 19.17 billion, as well as the company’s own guidance range of RMB 19.11 billion to RMB 19.67 billion. Despite this setback, Nio achieved a remarkable milestone, delivering a record 61,855 vehicles, outperforming its delivery guidance of 61,000 to 63,000 vehicles. This figure represents an 11.59% year-over-year growth and a 7.81% increase from Q2 2024.

Looking forward, Nio remains optimistic about its fourth-quarter projections, anticipating vehicle deliveries between 72,000 and 75,000 units, equivalent to a year-on-year growth between approximately 43.9% and 49.9%. To achieve this, Nio expects to deliver between 51,024 and 54,024 vehicles in November and December, building upon the 20,976 units delivered in October.

In terms of financial performance, Nio's gross margin climbed to 10.7%, surpassing analyst expectations of 10.6% and marking its highest level since Q3 2022. This increase is driven by improved vehicle margins alongside a rise in sales of higher-margin parts, accessories, and after-sales services. Notably, the vehicle margin reached 13.1% in Q3, compared to 11.0% in Q3 2023 and 12.2% in Q2 2024.

Despite its revenue underperformance, Nio shared positive news on cash flow, reporting that free cash flow has turned positive for the quarter, attributed to rising sales volumes and consistent margin improvements. CFO Stanley Qu reaffirmed the company’s direction, stating, “Starting next year, our three brands are poised to embark on a robust product cycle, projected to elevate the Company's sales volume to new heights.”

On the downside, Nio reported a net loss of RMB 5.06 billion, consistent with previous quarters yet reflecting an 11% increase compared to the same period last year. Adjusted non-GAAP net loss for the quarter stands at RMB 4.41 billion, also marking an increase from the previous year.

Nio’s commitment to innovation remains firm, as evidenced by its investment of RMB 3.32 billion in research and development this quarter, a 9.2% increase year-on-year, aimed at enhancing vehicle technology and operational efficiency. As of September 30, 2024, the company's total cash reserves including cash equivalents and investments amounted to RMB 42.2 billion, providing a financial cushion as it navigates market challenges.

As Nio gears up for the upcoming quarter, the EV market remains competitive, with industry giants continuously innovating. Will Nio's new product cycle be enough to reclaim its place in the fast-evolving electric vehicle arena? Stay tuned for further developments!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)