Porsche Faces Continued Decline in Chinese Market: Major Changes Ahead!

2025-01-13

Author: Siti

Porsche's Decline in China

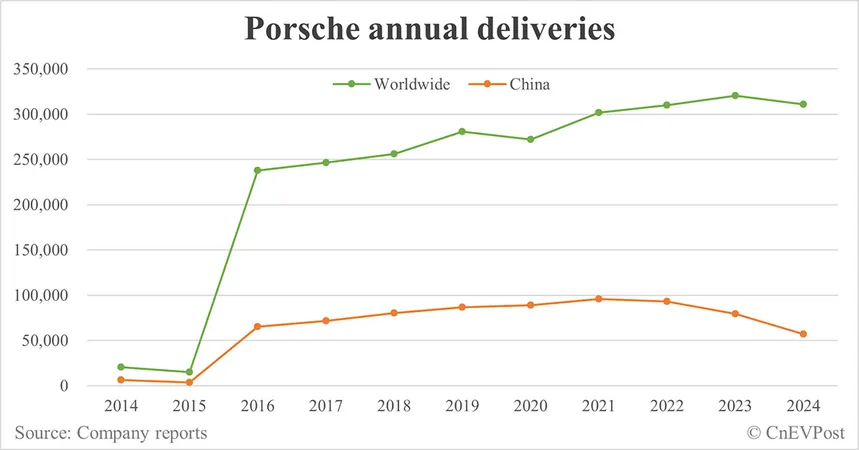

Porsche has reported a staggering 28% drop in deliveries in China for 2024 compared to the previous year, marking the third consecutive year of declining sales in the world's largest automotive market. This downturn has significantly affected Porsche's overall global performance, resulting in a 3% decrease in total deliveries from 2023, bringing their global tally to 310,718 vehicles.

Sales Figures Breakdown

In numbers, Porsche delivered only 56,887 units in China this year, a sharp decline from 79,283 units in 2023. This alarming trend has led Porsche to reassess its business strategy in the region, where it has historically enjoyed robust growth. Since entering the Chinese market in 2001, the luxury car manufacturer experienced a remarkable climb in sales, peaking in 2021 with an impressive 95,671 units sold. The downturn in 2022, which saw a 2.5% drop, was the first sign of trouble, further exacerbated by another 15% decline in 2023.

Market Challenges

Compounding the problem is the fierce competition in the luxury segment, alongside shifts in consumer preferences and new players entering the market. To address this slump, Porsche has announced plans to significantly downsize its retail presence in China, aiming to reduce its dealership network from 144 outlets to around 100 by 2027. This strategy reflects a broader reassessment of their market approach in the region.

Growth Elsewhere

Interestingly, while China has been facing this decline, other markets are showing growth. North America emerged as Porsche’s largest market, contributing a modest increase of 1% with 86,541 deliveries. Germany also showed positive results with an 11% rise in deliveries to 35,858 vehicles, while European markets outside Germany rose by 8% to 75,899 units.

Workforce Adjustments

As part of its restructuring efforts in China, there have been reports of potential layoffs, with sources suggesting a workforce reduction of approximately 30%. This move is likely aimed at cutting costs in response to the declining sales figures.

Conclusion

In summary, Porsche is embarking on a significant retrenchment in China, a market that was once its crown jewel, as it grapples with intense competition and evolving market dynamics. The prestigious carmaker's future in this crucial market remains uncertain as they adapt to these challenging circumstances. Will Porsche bounce back, or is this the beginning of a long-term decline in the Chinese luxury automotive market? Stay tuned!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)