Shocking Exodus: U.S. Spot Bitcoin ETFs Face Record $671.9M Outflow Amid Dipping CME Futures Premium

2024-12-20

Author: Wei Ling

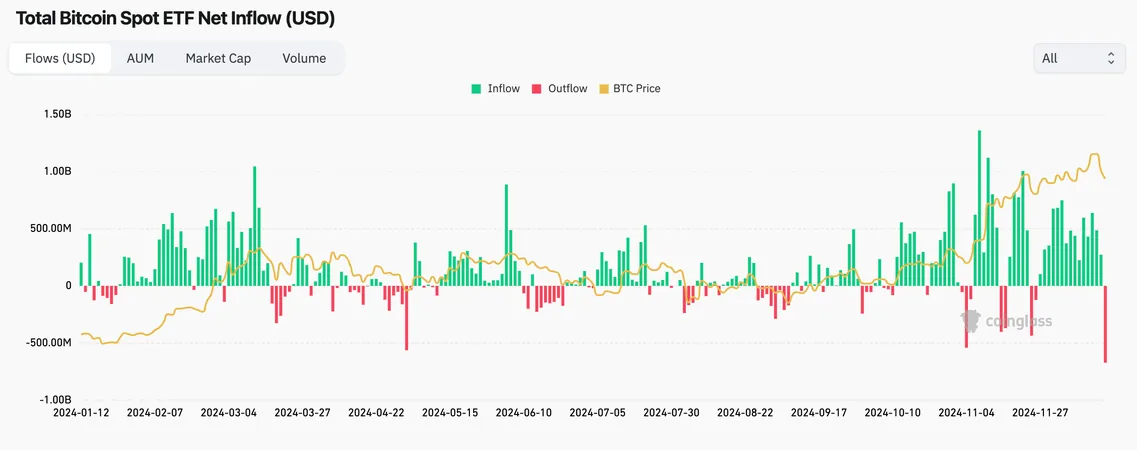

In a stunning turn of events, U.S.-listed spot Bitcoin (BTC) exchange-traded funds (ETFs) have experienced unprecedented outflows, reaching an alarming $671.9 million on Thursday. This significant withdrawal marks the largest single-day net outflow since these investment vehicles were launched on January 11. Data from Coinglass and Farside Investors illustrates a stark decline in short-term demand for Bitcoin as the market reacts to recent Federal Reserve decisions.

The outflows broke a 15-day streak of inflows, with leading funds such as Fidelity's FBTC and Grayscale's GBTC bearing the brunt of the withdrawals. Fidelity’s FBTC saw a staggering $208.5 million leave the fund, while Grayscale's GBTC lost $188.6 million. In a worrying trend, even BlackRock's IBIT reported zero inflows for the first time in several weeks, indicating a broader market sentiment shift.

As investors reacted to the latest economic signals, Bitcoin's price plunged to $96,000, reflecting a nearly 10% drop from its earlier record peak of $108,268 just this week. This heightened bearish sentiment was also evident within the derivatives market. The CME’s regulated one-month Bitcoin futures premium plummeted to 9.83%, marking the lowest level in over a month, according to data from Amberdata.

A declining futures premium typically suggests diminished cash-and-carry arbitrage opportunities. Investors employing strategies that involve going long on ETFs while shorting CME futures are now facing reduced profitability, further contributing to the weak demand for these funds.

Adding to the gloomy outlook, Ether ETFs also witnessed significant outflows, totaling $60.5 million for the first time since November 21. The price of Ether itself has tumbled more than 20% since it peaked above $4,100 before the Fed's recent announcements.

Market analysts are closely watching these trends, with many speculating that the current atmosphere of uncertainty could linger. As institutional support wavers and retail sentiment sours, could this be a pivotal moment for the cryptocurrency landscape? Stay tuned as we uncover the implications of these shifts in demand and their potential impact on the future of digital assets.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)