Shocking Fraud Unveiled: Singapore Man Ordered to Pay $2.38 Million Over Fake Diamond Scheme

2024-11-21

Author: Mei

SINGAPORE

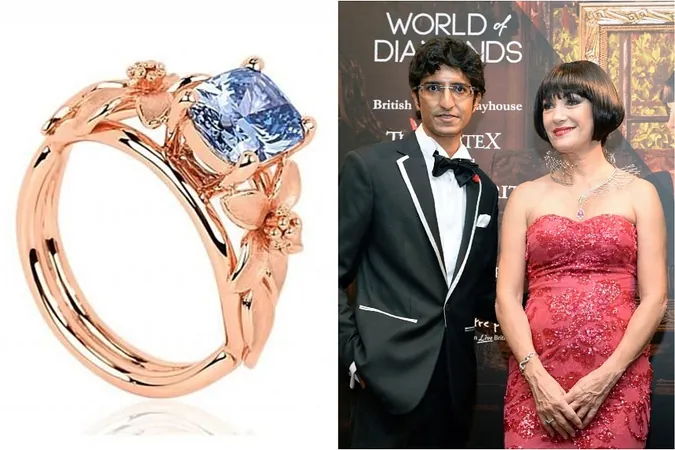

In a stunning turn of events, the Singapore Court of Appeal has unveiled a fraudulent diamond investment scheme led by 32-year-old Karan Chandur Tilani, culminating in a monumental $2.38 million award in damages to Dutch investor Maarten Hein Bernard Koedijk. The case brings to light a complex web of deception surrounding a purported 2.08-carat “fancy vivid blue” diamond ring, misleading investors with inflated claims and fabricated narratives.

The court's recent disclosure follows Mr. Tilani's failed attempt to keep arbitration details confidential, sparking a media frenzy. Documents reveal that Mr. Tilani falsely claimed the diamond, linked to actress Jane Seymour, was naturally mined and had an astounding worth of around $13.8 million. However, upon thorough investigation, the court determined that the diamond was synthetic, purchased for a mere $19,136 (S$25,695).

The saga began in 2021 when Mr. Tilani, director of the now-controversial Fantastic Xperience (FXPL), entered into a transaction with Mr. Koedijk, selling nearly half of his company's shares. The deal included cash and a staggering $2 million in cryptocurrency. Tensions rose when Mr. Tilani claimed Mr. Koedijk owed him an additional $339,659, leading to arbitration proceedings that would soon reveal a potential fraud.

Mr. Koedijk countered by asserting that he was misled into participating in a fractional ownership investment scheme rather than a legitimate purchase of company shares. Mr. Tilani reportedly proposed that Mr. Koedijk temporarily control the shares while he worked on selling the diamond, claiming that it would eliminate any “conflict of interest.”

The plot thickened when it was unveiled that Mr. Tilani used promotional materials, including a misrepresented Forbes article, to convince investors of the diamond's supposed rarity, despite denying he had claimed it was naturally mined.

Compounding the scandal, the ring itself had been previously showcased in a luxury dining event priced at $2 million, which Mr. Tilani claimed would support humanitarian efforts in Nigeria. Reports from distinguished outlets such as Forbes and CNBC touted the extravagant event, yet subsequent investigations revealed significant discrepancies in Mr. Tilani’s accounts.

Justice Lai Siu Chiu, overseeing the case, dismissed Mr. Tilani's claims, labeling them as fraudulent. She underscored the use of spurious expert valuations and criticized the comparisons drawn between the synthetic diamond and illustrious natural gems.

Ultimately, the court voided the sale agreement between Mr. Tilani and Mr. Koedijk, asserting that the Dutch investor had been victimized by false representations. The ruling mandates Mr. Tilani to reimburse Mr. Koedijk $648,601 and pay damages totaling approximately $2.38 million alongside substantial legal costs exceeding $500,000.

This case isn't Mr. Tilani's first brush with controversy. Back in 2021, The Straits Times reported that the police were investigating his diamond investment scheme following allegations of fraud. However, after a thorough review, the authorities concluded no further actions would be taken against him.

As more details emerge, this legal battle raises serious questions about due diligence in high-stakes investments and serves as a cautionary tale for investors everywhere. Investors beware: not everything that glitters is gold!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)