The Rise of AI Agents: How Digital Coworkers are Transforming the Insurance Industry Amidst a Talent Crisis

2025-01-13

Author: Ming

The Rise of AI Agents: How Digital Coworkers are Transforming the Insurance Industry Amidst a Talent Crisis

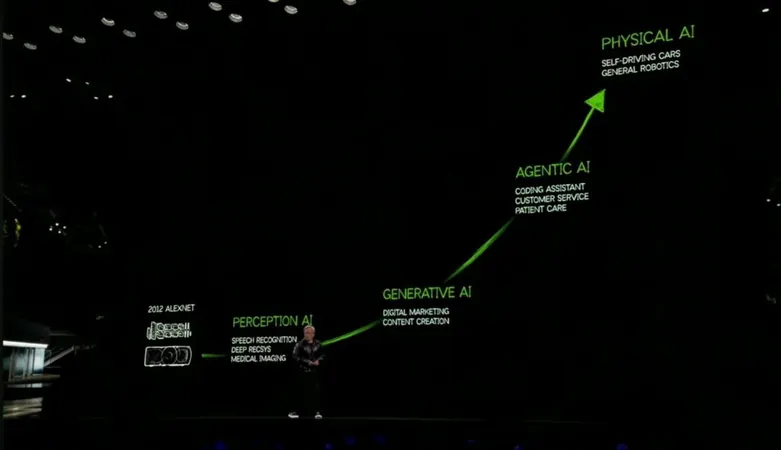

In a powerful keynote at CES, NVIDIA CEO Jensen Huang remarked, “The IT department of every company is going to be the HR department of AI agents in the future.” This statement signifies a crucial transition in how businesses, especially in the insurance sector, will not only manage but also integrate AI-powered digital workforces into their operations.

With the insurance industry facing a daunting 'silver tsunami' of retiring professionals and finding it challenging to attract younger talent, AI agents represent a timely and innovative solution. These digital workers are redefining claims processes, boosting efficiency, and equipping insurers to adapt to rapid industry changes.

The Talent Crisis in the Insurance Sector

A significant challenge confronting the insurance industry is the dual threat of an aging workforce nearing retirement age and a lack of enthusiasm among younger generations to join the field. With seasoned adjusters and claims professionals moving on, companies face operational bottlenecks, loss of valuable institutional knowledge, and stretched resources. Efforts to recruit new talent have proven inadequate, compelling insurers to rethink their talent acquisition and operational strategies.

This situation highlights the urgent need for innovation. While the expertise of human workers remains irreplaceable, AI agents can effectively supplement this expertise, ensuring a seamless transition and ongoing operational continuity.

How AI Agents Are Revolutionizing the Industry

Digital coworkers, particularly those created by Agentech, are changing the landscape of insurance by automating repetitive, mundane tasks. This allows human professionals to dedicate more time to higher-value and strategic decision-making. AI agents do not replace human workers but enhance their effectiveness by streamlining processes and managing administrative burdens.

**Key Use Cases for AI Agents in Insurance:**

- **Claims Triage and Assignment:** AI agents efficiently categorize incoming claims based on their complexity or nature, directing them to suitable adjusters according to their workload and location. This capability drastically speeds up response times and ensures that claims are handled by the right professionals.

- **File Review Automation:** With the ability to swiftly review claims files, AI agents identify inconsistencies, flag missing documentation, and ensure that files are correctly structured. They ensure compliance with carrier guidelines and best practices, significantly lightening the load for claims handlers.

- **Optimizing First Notice of Loss (FNOL):** AI agents streamline the FNOL process by automating data gathering, identifying gaps in information, and facilitating quick claim setups. They also assist with suggested communication templates for adjusters, enhancing customer interactions through real-time coaching.

- **Document Processing Mastery:** These agents can extract, categorize, and summarize data from complex claim documents, minimizing manual effort while maximizing accuracy. Regardless of the document's format or language, AI agents ensure that all essential information is neatly organized and accessible.

By addressing workforce shortages with these solutions, companies not only enhance operational efficiency and accuracy but also significantly boost customer satisfaction, which is vital for maintaining a competitive edge in the market.

Redefining IT and HR Roles

Huang’s foresight about IT departments evolving into HR entities for AI agents is particularly relevant to the insurance sector. Just as HR oversees the onboarding and development of human talent, IT professionals will increasingly manage the integration and optimization of AI agents. This new dynamic includes:

- **“Training” AI Agents:** Configuring these agents to align with the company’s specific terminology, workflows, and regulatory standards.

- **Performance Oversight:** Monitoring the output of AI agents to ensure they consistently meet organizational objectives.

- **Collaboration with HR:** Working alongside HR to explore how AI can complement human contributions and enhance the workplace experience.

Inter-departmental collaboration will be key as organizations adapt to this technological evolution.

Agentech’s Vision: Humans and AI Working Together

At Agentech, the emphasis is on empowering human workers with these digital counterparts. “Our AI Agents aren’t here to replace adjusters and claims handlers—they’re here to support them,” stated Robin Roberson, President and Co-Founder of Agentech. “By alleviating tedious tasks, we enable professionals to engage in meaningful interactions and strategic thinking that drive real value.”

The aim is clear: simplify workflows to foster innovation and boost efficiency. The automation of mundane tasks allows insurance professionals to concentrate on impactful decision-making, enhancing customer service, and crafting inventive solutions.

Preparing for a Tech-Driven Future

The introduction of AI agents in the insurance industry transcends immediate workforce challenges; it is about ensuring long-term sustainability. By leveraging these technologies, insurers can:

- Preserve critical institutional knowledge through AI-driven documentation and learning systems.

- Attract younger talent by providing modern, tech-focused roles.

- Scale operations effectively during high-demand scenarios, such as natural disasters or significant claims influxes.

Agentech’s AI agents promise marked improvements in operational metrics, including reduced claims cycle times and enhanced accuracy, which ultimately leads to higher policyholder satisfaction.

Conclusion: The Future is Here

Jensen Huang’s insights into the future of AI in business underscore the significant potential for intelligent automation. For the insurance industry, this shift is both timely and crucial. AI agents are not just a response to workforce challenges; they are opening doors to a collaborative future where humans and AI can work side by side.

As Agentech leads this transformation, insurance carriers are empowered with innovative tools that will help them thrive in an increasingly complex landscape. The future of the insurance industry looks bright, with digital coworkers driving efficiency and strategic growth. Are you ready to embrace this revolution?

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)