Unveiling Perseus: The Game-Changer in Tracking Pump-and-Dump Crypto Schemes

2025-03-24

Author: Nur

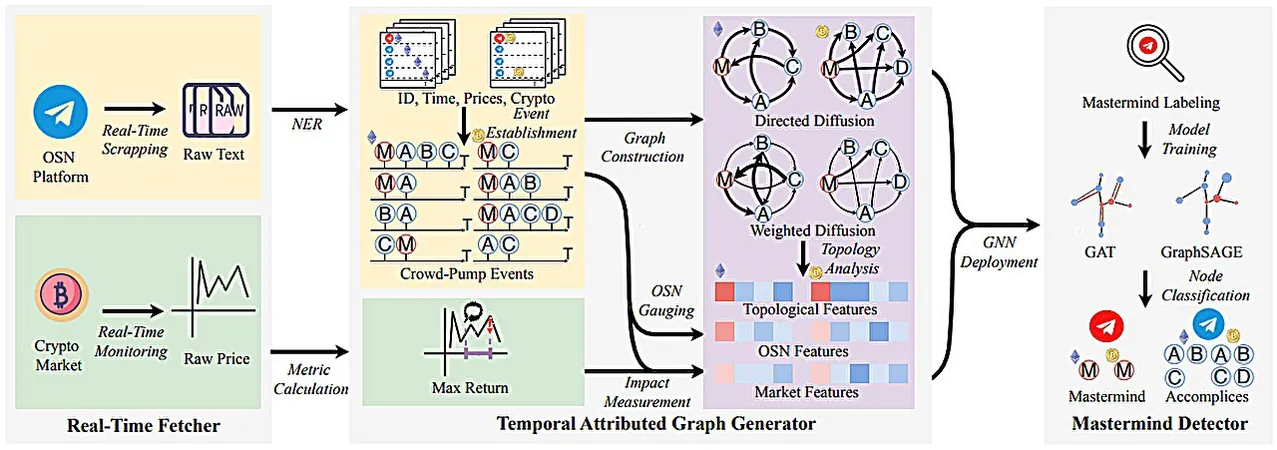

A groundbreaking development has emerged from a team of computer scientists and financial experts at University College London. They have created an innovative tracking tool named Perseus, designed specifically to monitor the deceptive practices underlying pump-and-dump schemes in the ever-evolving cryptocurrency market. Their insightful findings have been shared on the arXiv preprint server, detailing how Perseus operates and its pivotal role in unveiling fraudulent activities.

As the cryptocurrency landscape continues to grow rapidly, it remains largely unregulated, posing significant risks to investors. Current research identifies fewer than 500 key players—dubbed "masterminds"—responsible for manipulating market dynamics for personal gain. These individuals deploy pump-and-dump strategies, artificially inflating coin prices through aggressive promotions before selling off their holdings at a profit, often leaving naive investors with devalued assets.

Interestingly, much of this manipulation occurs on Telegram, a messaging platform favored by these masterminds. Here, they efficiently orchestrate their schemes by communicating with potential buyers and accomplices, allowing for a troubling rise in cryptocurrency speculation and trading.

The development of Perseus represents a significant step forward in consumer protection. This cutting-edge tool meticulously analyzes the archived messages exchanged on Telegram, revealing the identities of 438 masterminds and uncovering an astonishing $3.2 trillion in artificial trading linked to their activities. Collectively, these manipulative players are estimated to be reaping around $250 million annually, raising alarms about the integrity of the crypto market.

Upon reviewing communications among users, the research team noted a perilous ease with which these scams can operate, posing a severe threat to unsuspecting investors. They caution that without proper regulatory measures, these schemes could ultimately lead to widespread mistrust and market collapse as scammed investors become increasingly aware of the deceptive practices at play.

Investors should stay vigilant as these findings highlight the urgent need for oversight in the crypto arena, particularly as the popularity of cryptocurrencies continues to surge. Until meaningful regulations are introduced, tools like Perseus will be crucial in shedding light on the murky waters of cryptocurrency manipulation.

Stay informed, stay smart—don't let the masterminds of the crypto world pull the wool over your eyes!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)