What Do You Do When T-Bills and Fixed Deposit Rates Plummet Below 3%?

2025-03-30

Author: Yu

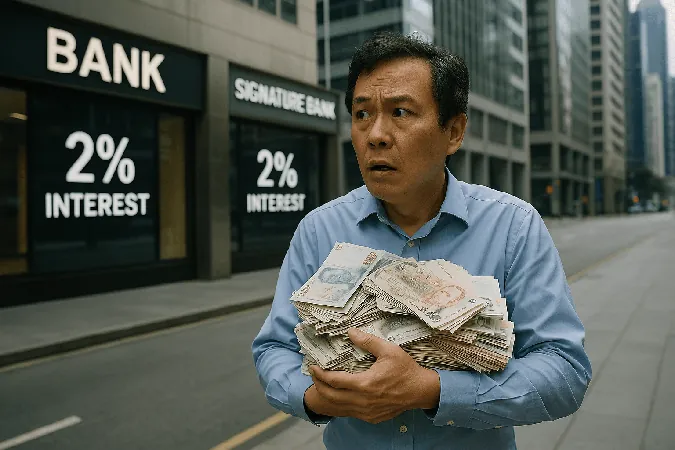

What Do You Do When T-Bills and Fixed Deposit Rates Plummet Below 3%?

For a considerable stretch of time, managing your investments was a straightforward affair. You could confidently place your money in fixed deposits or T-bills and enjoy returns nearing 4% with minimal risk. But the financial landscape is shifting, and those days of easy yields are fading fast.

Currently, interest rates have dipped below 3%, and forecasts indicate they might drop even further as central banks worldwide, including the US Federal Reserve, initiate rate cuts to bolster stumbling economies. In fact, the latest yield on a 6-month Singapore T-bill stands at only 2.73%, while many fixed deposit rates have also slipped below that critical threshold.

So, what are your options if you want to pursue higher yields? Here are several investment avenues that could provide more attractive returns—albeit with an uptick in risk.

1. Cash Management Accounts

Despite the lower interest rates, cash management accounts are one of the few remaining financial instruments that can still provide yields above 3%. Thanks to the emergence of robo-advisors and digital banking platforms, some institutions are offering enticing rates that can catch your eye:

- **Endowus:** 2.7% to 3.8% - **StashAway:** 2.5% to 3.6% - **Maribank:** 3.26% - **Syfe:** 2.3% to 3.2% - **Chocolate Finance:** 3.3% It's important to note that these figures are projected yields and not guaranteed returns. These accounts typically invest in money market funds, which include short-term bonds and T-bills. As rates decline, so too will returns—so proceed with caution. However, if the platform is regulated and your money is held securely, these accounts can still be considered relatively low-risk.

2. US Treasuries

In the realm of bonds, US Treasuries stand out by offering annualized yields exceeding 4%, providing an edge over many local alternatives. However, they come with a pair of significant risks:

1. **Currency Risk:** US Treasuries are in USD, which introduces foreign exchange risk if you primarily hold SGD. A weak USD can eat into your returns once converted back.

2. **Reinvestment Risk:** With maturities typically ranging from 6 to 12 months, reinvesting at a potentially lower yield could negate any initial advantages.

Investing in US Treasuries may simply defer more pressing challenges in your investment strategy rather than resolving them.

3. Bond Funds

Previously highlighted were four bond funds offering monthly interest payments with yields above 5%. Although they appear appealing, several factors necessitate caution:

- **Interest Rate Risk:** Even well-rated bond funds are susceptible to interest rate changes. Declining rates can reduce yields.

- **Expense Ratios:** Some funds carry expense ratios of over 1%, decreasing returns even further.

Despite the risks, bond funds offer potential benefits, including capital gains if interest rates decrease. However, keep in mind fluctuating inflation and its possible impact on bond performance.

4. REITs and Dividend Stocks

Transitioning from bonds to stocks, one must acknowledge the greater volatility and risk associated with equities compared to fixed-income investments. While certain stocks can provide stable earnings and reliable dividends, identifying high-quality stocks with sustainable dividend yields above 5% requires astute analysis.

Real Estate Investment Trusts (REITs) often appeal due to their requirement to distribute most earnings as dividends, leading to higher yields. Nevertheless, the interest rate hikes have pressured many REITs, affecting their stock prices and dividend payouts. Yet, there are resilient REITs worth exploring.

Moreover, banks have been a favored choice among dividend stocks, showcasing robust earnings and special dividends even amidst higher rates. Notably, the Lion-OCBC Securities APAC Financials Dividend Plus ETF (YYY) has experienced an impressive 13% growth since its inception.

What’s Your Best Investment Strategy?

There’s no magic solution—no single product can meet all your investment needs. Instead, the key to navigating this low-rate environment is to cultivate a diverse investment portfolio. Consider a mix of cash management accounts, short-term bonds, dividend stocks, and select growth opportunities to hedge against varying economic climates.

While we've enjoyed a stretch of 3-4% yields from safe instruments, that window is closing. Now is the critical time to reassess and strategically position your investments for the uncertain times ahead. Don't wait for rates to dip further and your options to narrow! Explore these avenues now and secure your financial future!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)