Soneil Investments Makes Waves with $100 Million Acquisition of Prime Industrial Complex in GTA

2024-12-18

Author: Amelia

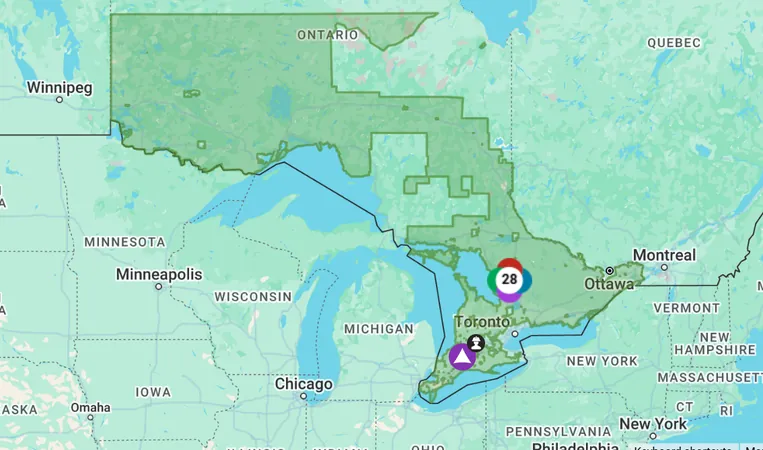

In a bold move that underlines its expanding influence in the Greater Toronto Area (GTA), Soneil Investments has purchased the Millcreek Business Centre, which encompasses seven substantial industrial buildings in Mississauga, totaling an impressive 324,362 square feet across a sprawling 20 acres. This transaction is valued at over $100 million and comes from GWL Realty Advisors, known for their strategic real estate investments.

The history of Millcreek Business Centre reveals a fruitful trajectory for GWL Realty Advisors, who initially acquired a 50% stake in these buildings back in June 2003. Over time, as detailed in their 2020 annual report, they increased their ownership to a full 100%.

Neil Jain, the President and CEO of Soneil, expressed pride in this acquisition, calling it their "single largest industrial acquisition to date." He noted, “To close such a significant deal in the current market conditions demonstrates our commitment and strategic vision.”

Competitive Market Dynamics and Current Occupancy Rates

Brokered by Colliers, the acquisition process was intensely competitive, highlighting the strong demand among institutional buyers for prime industrial properties in the area. Jain remarked on the virulent interest in these assets, which underscores the growing industrial market's strength.

The diverse buildings at Millcreek Business Centre range from 34,950 to 63,401 square feet and were constructed between 1987 and 1989. Remarkably, apart from one vacant building, the portfolio boasts a robust occupancy rate of 92%, with 31 tenants enjoying a weighted average lease term of approximately 3.54 years. Current rent levels are about 18% below market rates, offering Soneil considerable upside potential for future rent increases.

"With average rents around $15.50, we are ensuring a mix of stability and growth potential," Jain stated. The tenant base includes a variety of businesses, reflecting both national chains and local enterprises, thereby minimizing concentration risk—as the average tenant occupies less than 10,000 square feet.

Strategic Location and Future Outlook

Millcreek Business Centre's strategic location enhances its attractiveness for industrial activities. The site provides excellent access to major commuter roads, 400-series highways, public transit networks, Toronto Pearson International Airport, and nearby rail intermodal terminals. Jain emphasized this region as "one of the strongest performing industrial nodes in the GTA and across Canada."

While industrial rent growth has stabilized, Jain noted that the demand for smaller, manageable spaces remains robust, facilitating organic growth opportunities for Soneil’s tenants.

Looking ahead, Soneil intends to continue its acquisition strategy targeting similar assets. With plans for further aggressive expansion in 2025 as market conditions improve, Jain anticipates picking up between $300 to $400 million in new acquisitions with lower interest rates and tighter bid-ask spreads.

“We’ve been active over the last few years, investing between $200 and $300 million annually,” Jain explained. "This year, after the Millcreek transaction, we’ll reach close to $150 million, but next year, we’re optimistic to ramp back up to our previous investment levels."

Additionally, Soneil is eyeing potential rezoning within its existing portfolio for future development. While this endeavor is a lengthy process, Jain reassured that the substantial cash flow from their current properties allows them to approach these opportunities without urgency.

As Soneil Investments continues to expand its footprint, the industrial landscape of the GTA is set to evolve, presenting exciting prospects for investors and tenants alike in the coming years. Stay tuned as we follow their journey!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)