Buyers' Strike Persists: Pending Home Sales Show Slight Increase, Yet Remain in a Slump

2024-12-30

Author: Ying

Overview of Pending Home Sales

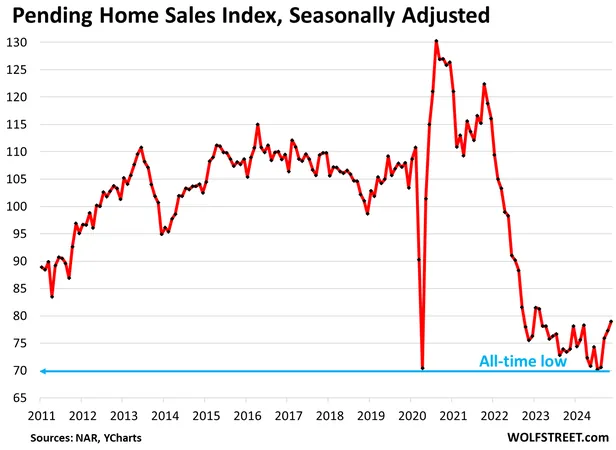

In a housing market still characterized by high prices, a recent report from the National Association of Realtors (NAR) reveals that pending home sales, which serve as a predictive indicator for closings, showed a slight uptick but remain entrenched in a stagnant state.

NAR Data Insights

According to NAR data, pending home sales plummeted by 20.1% in November compared to October, primarily influenced by the Thanksgiving holiday. However, when adjusted for seasonal fluctuations, they actually experienced a modest increase of 2.2%. Year-over-year comparisons showcase a rise of 5.6% in unadjusted pending sales and a healthier 6.9% when seasonally adjusted — a small bonus coming off the significant lows registered in July, which marked an all-time low for this dataset.

Ongoing Market Challenges

It's essential to note that while the numbers reflect a slight rebound, they still linger in a "frozen zone," highlighting ongoing issues such as exorbitant prices that are preventing a more robust recovery. For instance, pending sales compared to the same time last year reveal this trend dramatically, with November 2022 recording an increase of just 4.6% from November 2021, which had seen declines of 33.5%.

Regional Performance Variability

Regionally, the performance varied: the Northeast saw a slight decline of 1.3%, the Midwest increased by 0.4%, the West edged up by 0.5%, while the South experienced a solid jump of 5.2%. However, not adjusted for seasonal effects, all regions recorded substantial drops in transactions, underscoring some persistent difficulties across the market.

Consumer Behavior Shifts

NAR highlighted some notable shifts in consumer behavior: “It appears that consumers have recalibrated their expectations concerning mortgage rates and are taking advantage of the increased inventory available in the homes market.” With mortgage rates hovering above 6% for the last two years, buyers seem to have abandoned hope for substantial decreases in rates and are instead focusing on negotiation opportunities amidst a changing market landscape.

Current Mortgage Rates

In December, the average 30-year fixed mortgage rate increased to 6.85%, up from lower figures recorded in November. These rates, significantly higher than those seen during the period of extensive quantitative easing, suggest that the previous era of historically low borrowing costs may not return.

Inventory Trends

The supply of homes on the market is also shifting, with a notable increase in available inventory, including new constructions, that buyers can choose from. The existing home supply reached a notable 3.8 months, the second highest for any November in the last eight years, following only 2018's peak. Interestingly, data from the Census Bureau highlighted a year-over-year spike of 57% in the inventory of completed new houses, reaching 124,000 units — evidence of a supply surge that builders are tackling by increasing incentives and reducing prices.

Mortgage Applications and Future Outlook

Despite the slight uptick in mortgage applications — an early indicator of home sales — these figures still reflect a drastic drop compared to previous years. Reports show a 5.6% increase week-over-week, yet year-over-year comparisons indicate a 14% decline from 2022 and an even steeper 45% drop from 2021.

Conclusion

As we move further into December, the housing market's attempts to stabilize remain fraught with challenges. High prices and fluctuating mortgage rates continue to keep many potential buyers on the sidelines while inventory levels rise. This ongoing buyers' strike might serve to reshape the landscape, leading to a long-term adjustment in how the market performs in the years to come.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)