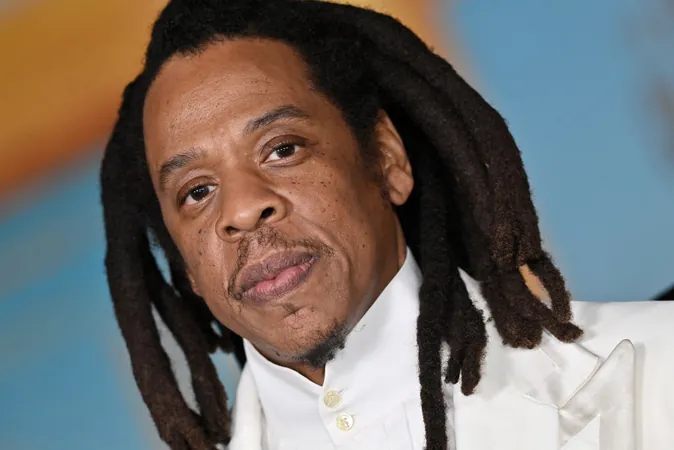

Jay-Z's Marcy Venture Partners Joins Forces with Pendulum Holdings to Create a $900 Million Investment Powerhouse

2024-12-16

Author: Wai

In an exciting development for the investment landscape, Jay-Z’s Marcy Venture Partners has officially merged with the investment arm of Pendulum Holdings, known as Pendulum Opportunities, to create a formidable entity named MarcyPen Capital Partners. This new partnership aims to capitalize on diverse investment opportunities while supporting the growth of Black-owned businesses, marking a significant player in the venture capital realm.

MarcyPen Capital Partners now boasts an impressive $900 million in assets under management, as confirmed by industry analysis firm PitchBook. This merger signifies a strategic move to bolster financial influence and enhance investment capabilities.

Although a spokesperson for MarcyPen declined to provide further details on the merger, databases like Prequin and official filings with the California Secretary of State verify that the merger was completed around September this year. This timeline suggests an efficient consolidation, with both firms pooling resources to further their mutual goals.

Following the merger, MarcyPen is already moving quickly. Before the union, Pendulum Opportunities was actively seeking to raise a second fund, aiming for a target of $250 million. This endeavor continues under the new banner of MarcyPen Opportunities Fund II, which has already garnered over $100 million through initial fundraising efforts, as detailed in SEC filings.

Founded in 2018 by Jay-Z, Jay Brown (co-founder of Roc Nation), and Larry Marcus (who previously co-founded Walden VC), Marcy Venture Partners has been at the forefront of investing in innovative companies. Their portfolio includes notable names such as Partake Foods, a brand focused on gluten-free snacks, web3 technology company Spatial Labs, and Rihanna’s renowned lingerie brand Savage x Fenty.

As they embark on their new journey as MarcyPen Capital Partners, industry watchers are eager to see how they will leverage their combined resources to drive meaningful change and champion the growth of underrepresented businesses within the venture capital sector. This powerful collaboration is poised to make waves in the investment world, potentially altering the way emerging businesses receive funding and support.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)